In the relentlessly dynamic world of foreign exchange, where milliseconds dictate fortunes and global events reshape landscapes in an instant, traders are constantly seeking that elusive analytical edge. For decades, many have relied on conventional charts—candlesticks, bars, and line graphs—to decipher price action. Yet, an increasingly sophisticated methodology, traditionally revered in futures and equities, is now powerfully emerging as a game-changer for currency markets: the Market Profile. But does this intricate framework truly work in Forex, or is it merely another complex tool destined for the intellectual dustbin?

The answer, resoundingly, is a nuanced yet emphatic yes. Far from being a relic, Market Profile offers a profoundly different lens through which to view market activity, moving beyond mere price to reveal the underlying ebb and flow of market participation and value acceptance. By meticulously charting the distribution of price over time, it provides a three-dimensional perspective, helping traders identify areas where the market has truly built consensus, known as “value areas,” and pinpointing critical levels where significant institutional interest resides. This advanced approach, when strategically applied, can significantly enhance decision-making, offering a clearer roadmap through the often-turbulent Forex terrain.

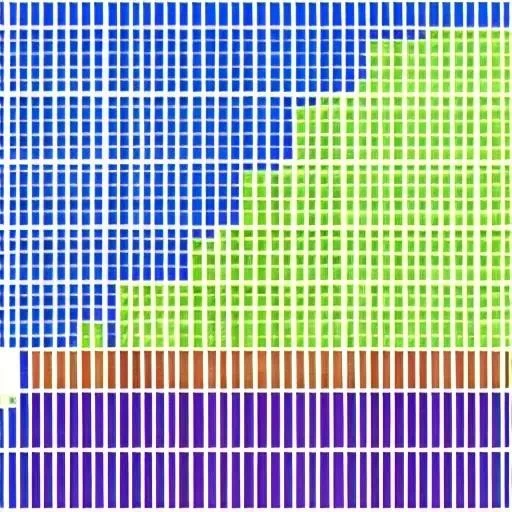

Here’s a closer look at the foundational elements and application of Market Profile:

| Concept | Description | Relevance in Forex |

| Originator | J. Peter Steidlmayer, Chicago Board of Trade (CBOT) in the 1980s. | Pioneered a method for visualizing market activity beyond simple price charts. |

| Core Principle | Organizes price data into a bell-shaped distribution over time, revealing areas of market acceptance and rejection. It highlights where “value” is being established. | Helps identify true consensus price levels and significant turning points, crucial for a decentralized market like Forex. |

| Key Components |

| These components provide structural insights into market balance/imbalance, institutional footprints, and potential support/resistance levels. |

| Primary Application | Identifying institutional activity, understanding market sentiment, predicting short-term reversals, and enhancing risk management. | Enables traders to anticipate market shifts, manage trades more effectively, and align with larger market participants’ actions. |

| Reference |

The transition of Market Profile from its traditional stronghold in centralized futures exchanges to the vast, decentralized Forex market has been remarkably successful, albeit requiring thoughtful adaptation. Unlike futures, Forex lacks a single, centralized exchange volume data, necessitating a focus on price distribution and time-based opportunities. Yet, this hasn’t deterred its most ardent proponents. According to Dr. Elena Petrova, a celebrated quantitative analyst and head of proprietary trading at Quantum FX Solutions, “Market Profile, when skillfully integrated with modern tools like aggregated volume data from major liquidity providers, offers an unparalleled lens into institutional order flow and market structure, effectively democratizing insights previously reserved for the largest players. It reveals the market’s true character.”

What makes Market Profile so incredibly effective in Forex? Firstly, it shines a spotlight on genuine value. Traders are not merely reacting to price swings but understanding why those swings are occurring and where the market is finding equilibrium. The “Point of Control” (POC), for instance, represents the price level where the most trading activity has transpired, acting as a magnetic core of value. Unvisited POCs, often termed “Naked POCs,” frequently serve as future price targets, providing remarkably accurate predictive power for discerning traders. Secondly, it offers a robust framework for risk management. By clearly defining value areas and identifying areas of acceptance or rejection, traders can set more logical stop-loss and take-profit levels, significantly enhancing their risk-reward profiles.

Furthermore, Market Profile cultivates a deeper understanding of market psychology. It helps distinguish between impulsive, emotional trading and deliberate, institutional positioning. Recognizing when the market is “balanced” (trading within a value area) versus “imbalanced” (breaking out of value) equips traders with a powerful psychological edge, allowing them to anticipate shifts in market behavior rather than simply reacting to them. This proactive approach, driven by objective data visualization, reduces emotional trading errors and fosters a more disciplined methodology, critically important for sustained success in the high-stakes Forex arena.

While the learning curve for mastering Market Profile can be steep, demanding dedication and practice, the rewards are profoundly impactful. It’s not a magic bullet but a sophisticated analytical framework that, when combined with other technical and fundamental analysis, can unlock a deeper dimension of market understanding. Forward-thinking professional traders are increasingly incorporating its principles, viewing it as an indispensable tool for navigating complex market structures and identifying high-probability trading setups. As technology continues to evolve, integrating AI-driven insights with Market Profile charting could further amplify its power, offering even more precise predictions and automated pattern recognition capabilities.