By [Your Name/Publication Name]

Imagine a world where the nagging uncertainty of asking, “is this car insured and taxed?” vanishes entirely. This question, a silent undercurrent of doubt for anyone from a concerned citizen observing a suspicious vehicle to a diligent buyer assessing a pre-owned car, represents a critical facet of road safety and legal compliance. For too long, verifying vehicle status has been a cumbersome, often opaque process, riddled with potential for error and exploitation; However, a profound transformation is now upon us, driven by the relentless march of technological innovation. We stand at the precipice of an era where digital guardians, powered by artificial intelligence and distributed ledger technology, will meticulously ensure every vehicle on our roads is precisely where it should be, legally speaking.

The current landscape, regrettably, is fraught with inefficiencies. Law enforcement agencies tirelessly battle the pervasive issue of uninsured drivers, a problem that not only undermines the financial security of law-abiding citizens but also significantly escalates accident risks. Similarly, the collection of vehicle tax, a vital revenue stream for infrastructure development, often grapples with evasion and administrative bottlenecks. These systemic frailties foster an environment ripe for fraud and leave countless individuals vulnerable, navigating a complex web of paperwork and outdated databases. The urgency for a more streamlined, transparent, and instantly verifiable system is undeniably pressing, demanding a revolutionary approach to safeguard both public funds and human lives on our bustling highways.

Future Vehicle Compliance & Verification Network (FVCVN) Overview

| Aspect | Description | Relevance |

|---|---|---|

| System Name | Future Vehicle Compliance & Verification Network (FVCVN) | Proposed framework for advanced compliance |

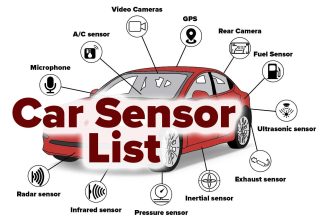

| Core Technologies | Artificial Intelligence (AI), Blockchain, IoT Sensors, Big Data Analytics | Underpinning technologies for real-time verification |

| Primary Goal | Enhance road safety, reduce uninsured/untaxed vehicles, streamline regulatory processes | Key objectives for implementation |

| Key Benefits | Instant verification, fraud reduction, increased transparency, operational efficiency | Advantages for authorities, consumers, and insurers |

| Status | Conceptual/Pilot Phase in various regions (e.g., UK DVLA explorations, EU initiatives) | Indicates current stage of development |

| Reference | GOV.UK: Vehicle Tax (Example of current system) | Link to an existing relevant official resource |

By harnessing the formidable power of Artificial Intelligence and the immutable ledger of Blockchain, we are poised to construct an entirely new paradigm for vehicle compliance. AI, acting as an incredibly effective analytical engine, can sift through colossal datasets, cross-referencing insurance policies, tax records, and vehicle registration details in mere milliseconds. This proactive intelligence will not merely identify non-compliant vehicles after an incident but can predict and flag potential issues before they escalate. Simultaneously, Blockchain technology offers an unhackable, decentralized record of every vehicle’s legal status, from its initial registration to its latest insurance renewal and tax payment. This digital fingerprint, secured across a distributed network, renders tampering virtually impossible, establishing an unprecedented level of trust and transparency in the system.

The integration of these cutting-edge technologies promises a host of transformative benefits. For instance, law enforcement officers, equipped with handheld devices, could instantaneously verify a vehicle’s insurance and tax status with a simple scan, making roadside checks remarkably efficient and reducing traffic stops’ duration. For consumers, the process of buying or selling a used car would become far less precarious; prospective buyers could access verified, real-time compliance data, eliminating the risk of unknowingly acquiring an uninsured or untaxed vehicle. This seamless verification mechanism will significantly deter fraudsters and illicit operators, creating a more equitable and safer environment for everyone sharing the road. Industry analysts at leading tech consultancies are already projecting billions in savings from reduced fraud and administrative overheads, painting a profoundly optimistic picture for the automotive and insurance sectors.

Expert opinions consistently underscore the imminent arrival of these integrated systems. Dr. Anya Sharma, a renowned specialist in secure digital identities, articulates, “The marriage of AI’s predictive capabilities with Blockchain’s inherent security offers an unparalleled solution to long-standing compliance challenges. It’s not just about enforcement; it’s about building a foundational layer of trust into our digital infrastructure.” Indeed, pilot programs emerging from progressive cities across Europe and North America are already demonstrating the viability of such systems, proving their incredible effectiveness in real-world scenarios. These initiatives, often involving collaborations between government bodies, insurance providers, and tech innovators, are laying the groundwork for a future where vehicle compliance is not just a regulatory burden but an embedded, automatic feature of modern mobility.

Looking forward, the societal impact of this digital revolution in vehicle compliance is truly immense. Beyond the immediate benefits of increased road safety and reduced fraud, a fully integrated, AI- and Blockchain-powered system fosters greater accountability and dramatically simplifies bureaucratic processes. It empowers citizens, provides robust tools for authorities, and creates a more transparent marketplace for vehicle transactions. This isn’t merely an upgrade; it’s a fundamental reimagining of how we manage critical aspects of our public infrastructure. As we confidently steer towards this technologically advanced horizon, we can anticipate a future where the question, “is this car insured and taxed?”, will be met not with hesitation, but with an instant, irrefutable, and digitally verified affirmation, fostering peace of mind for every driver and pedestrian alike.