For many, the concept of government finance conjures images of tax revenues and public spending, perhaps a national debt figure flashing across news screens. Yet, beneath this visible layer of fiscal management lies a far more dynamic and often overlooked reality: governments worldwide are not just taxing and spending; they are increasingly becoming sophisticated players in the global stock market. This strategic shift, driven by a profound understanding of long-term economic growth and intergenerational wealth creation, is quietly revolutionizing how nations secure their financial futures, transforming passive coffers into active engines of prosperity. It’s a testament to forward-thinking leadership, embracing market dynamics to build resilience and opportunity for citizens for decades to come.

This isn’t merely about chasing quick returns; it’s a meticulously calculated strategy designed to achieve monumental national objectives. Governments are wisely diversifying their national assets, moving beyond traditional reserves of gold or foreign currency, to tap into the potent growth potential offered by equity markets. Whether funding future pension liabilities for an aging population, underwriting ambitious infrastructure projects, or creating stabilization funds to weather economic storms, the rationale is compellingly clear: leverage capital markets to generate sustainable, long-term returns. By strategically investing in a broad spectrum of companies, from innovative tech giants to established industrial leaders, these governmental entities are not only growing their portfolios but also implicitly fostering global economic development, demonstrating a commitment to robust and diversified financial health.

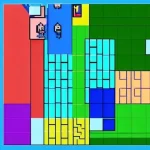

| Vehicle Type | Primary Purpose | Key Characteristics | Example(s) & Reference |

|---|---|---|---|

| Sovereign Wealth Funds (SWFs) | Manage national savings, often from commodity surpluses or budget surpluses, for long-term growth and intergenerational equity. | Large, diversified portfolios; long investment horizons; often global reach; varying degrees of transparency. | Government Pension Fund Global (Norway) ⎼ nbim.no Singapore’s GIC ⎼ gic.com.sg |

| Public Pension Funds | Invest contributions from public sector employees and employers to provide retirement benefits. | Fiduciary duty to beneficiaries; focus on stable, long-term returns; often large institutional investors. | CalPERS (California Public Employees’ Retirement System) ⎻ calpers.ca.gov |

| State-Owned Enterprise (SOE) Investment Arms | Manage commercial assets and investments of government-owned companies, sometimes with strategic national interests. | Operate with a commercial mandate, but can be influenced by state policy; may invest domestically and internationally. | |

| National Development Banks | Provide financing for national development projects, often including equity investments in strategic industries. | Focus on specific sectors (e.g., infrastructure, energy); blend commercial and developmental objectives. |

Perhaps the most celebrated example of this sophisticated financial stewardship is Norway’s Government Pension Fund Global (GPFG). Often dubbed the ‘Oil Fund,’ it manages the nation’s vast petroleum revenues, investing them globally in equities, fixed income, and real estate. With a staggering value exceeding $1.5 trillion, it stands as the world’s largest sovereign wealth fund, a tangible illustration of how one nation, by prudently investing its temporary natural resource wealth, is securing an incredibly robust financial future for generations of Norwegians, far beyond the lifespan of its oil reserves. Similarly, Singapore’s Government of Singapore Investment Corporation (GIC) and Temasek Holdings, operating with distinct but complementary mandates, have transformed the city-state’s reserves into a formidable global investment powerhouse, consistently delivering strong returns across diverse asset classes, thereby bolstering Singapore’s long-term economic resilience and global standing.

The benefits of such proactive governmental investment strategies ripple profoundly through national economies and societies. Firstly, they foster economic stability, creating buffers against unforeseen crises and reducing reliance on volatile tax bases. Secondly, these funds are powerful engines of intergenerational equity, ensuring that today’s resource consumption or economic prosperity does not burden future generations, but rather provides them with a robust financial inheritance. Thirdly, by becoming significant institutional investors, governments can subtly influence global corporate governance towards more sustainable and ethical practices, leveraging their colossal capital for positive societal impact. This proactive approach, skillfully navigating complex global markets, represents a paradigm shift from passive treasury management to dynamic wealth creation, ultimately benefiting every citizen.

Of course, this journey is not without its complexities and carefully managed risks. Critics often point to concerns about political interference, transparency, and the potential for market volatility to impact public funds; Yet, modern government investment entities are increasingly adopting best-in-class governance frameworks, often inspired by leading private sector practices, to mitigate these very challenges. By integrating insights from advanced AI-driven analytics for risk management and implementing stringent ethical guidelines, these funds are remarkably effective at safeguarding assets and ensuring their long-term viability. The emphasis is consistently on professional management, diversified portfolios, and a commitment to long-term objectives, thereby transforming potential pitfalls into opportunities for refining investment strategies and enhancing public trust.